Credit Awareness Month 2019

October is Credit Awareness Month and it’s the perfect time to take stock of your own personal financial situation. Before you shop on Black Friday or Cyber Monday, it is a good idea to assess your financial health and see whether your spending plan is still on track to get you to your savings goals.

October is Credit Awareness Month and it’s the perfect time to take stock of your own personal financial situation. Before you shop on Black Friday or Cyber Monday, it is a good idea to assess your financial health and see whether your spending plan is still on track to get you to your savings goals.

- - - - -

Social Media

#Military: Did you know that beginning 10/31 you are eligible for FREE #Credit Monitoring from all 3 credit bureaus? Learn more by visiting: http://bit.ly/2os3Ac5

- - - - -

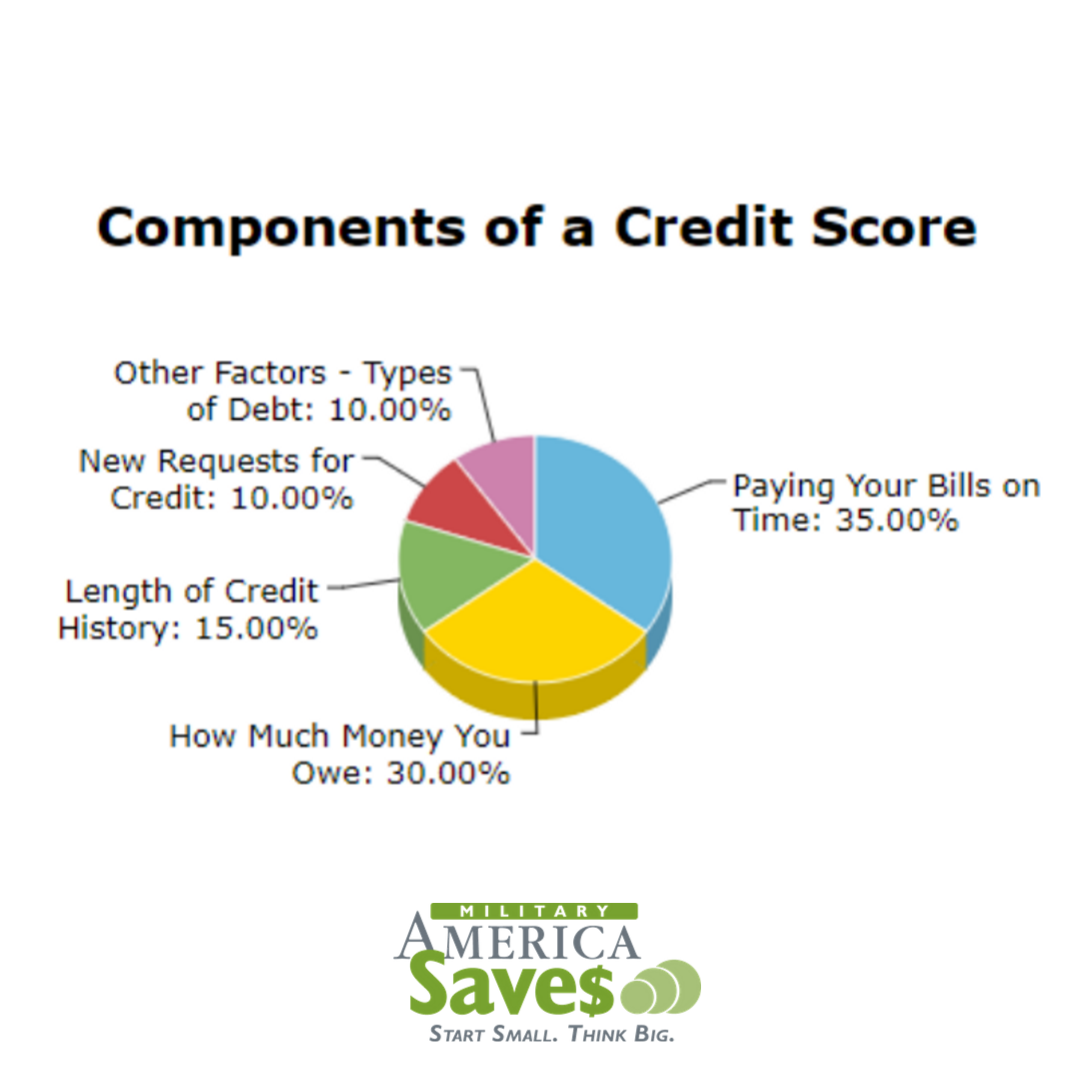

October is Credit Awareness Month! Ever wonder how exactly your credit score is calculated? Here’s some insight for you: http://bit.ly/2nPCoDH

“There’s no one right way to pay off debt.” Some people like to pay off the smallest debt first and others people pay off the debt with the highest interest rate first. Find this and other tips for for ‘Getting Out of Debt’ here: http://bit.ly/2opwhq1

- - - - -

What was the last time you looked at your credit report?

It’s not enough to know your FICO Score! By checking your credit report, you can ensure the information being reported is accurate.

- - - - -

New Blog Posts:

5 Quick Tips for Credit Awareness Month

Tips for Getting out of Debt Blog

- - - - -

Partner Resources:

Office of Financial Readiness - Consumer Credit Guide for Members of the Armed Forces

Office of Financial Readiness - Your Credit Score Matters

Saveandinvest.org - Dig Yourself out of Debt

Saveandinvest.org - Control Your Credit

MilitaryConsumer.gov - Being Smart About Using Credit Cards

CFPB - Servicemembers Civil Relief Act

Military OneSource Getting Out of Debt, a Step by Step Guide

Powerpay.org - Helping Debtors Become Savers

- - - - -

Events:

#SaveAutomatically Twitter Chat

Tuesday, October 29, 2019 at 2pm Eastern

The easiest and most successful way to save is to SAVE AUTOMATICALLY. Join us in a #SaveAutomatically Twitter Chat! During this chat we’ll encourage individuals to save and share how to #ThinkLikeASaver by setting a goal and making a plan.

- - - - -

From the Archives:

5 Ways to Capitalize on Your Credit CArds

Understanding Your Credit Profile Can Improve Your Financial Health